Whether you’re extending your family or you’ve been saving for a long time to be able to afford a larger property to live in, there are always factors to consider when moving home; and when upsizing your home there is no exception.

Never be on your own when looking for a new house, seek an estate agent advice – Love Your Postcode™ will always be able to guide you in areas that you are unsure in.

Why are you upsizing your property?

This may seem like a simple question but when it comes to choosing the right property, having a clear idea is crucial. Take your time to define what it is that your current property is lacking and what features your new home needs to have? Before beginning your search, consider not just the home’s square footage, but also the layout. Before you speed forward with your upsizing property plan, you should make sure the rooms or features in the larger house will actually be used.

The financial impact of upsizing a property

There’s been a lot of talk about moving into a smaller property as you grow older. However, if you’re only just starting to see your family grow, the upsizing is much more relevant. As your assets, family and needs increase, you might just find you’ve outgrown your house and need more space.

From increasing your mortgage to maintaining a larger property, there are many factors to be taken into consideration before you upgrade. Bigger homes come with bigger price tags. But the sales price isn’t the only inflated cost you’ll face when upsizing.

Property maintenance: – from the house itself to the grounds and garden, you’ll be responsible for caring for a greater area. This means a higher spend on maintenance.

Higher bills: Heating and lighting a larger home is generally more expensive.

Buying and moving costs: Besides the hire fee for the moving van, you’ll need to take account of the time taken off work to arrange your move, any new furniture needed to fill the home, stamp duty, and legal and estate agents fees.

The purchase price is not the only expense you will need to budget for. There are a number of other costs involved with upsizing that could definitely upset your finances if you are not aware of them.

What happens if I want to buy before I sell?

At Love Your Postcode™, we understand upsizing and purchasing a new property can be stressful and aim to make the home selling process as easy as possible so that you can focus on finding your next dream property. Contact our friendly team today.

Settling on a budget

Anytime you’re buying a new property, it’s important to know your price range. When you find a bigger place that you love, you’ll need to think beyond its asking price to understand the true costs associated with your purchase. If you want to get a sense of how much more you might be paying for a particular home, our advice is to talk to its current owners. Many sellers are happy to let buyers take a peek at their recent bills for major repairs and monthly utilities.

When to upsize your home

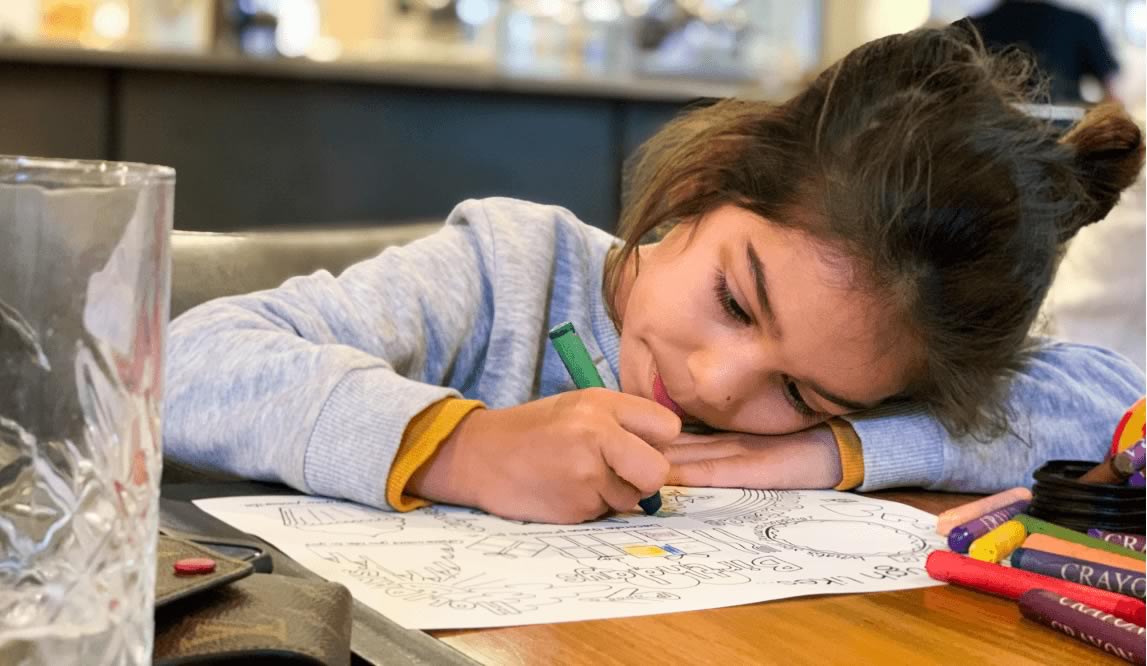

Privacy – If you have school-aged children who are approaching their secondary years, you will find that they will become more interested in having their own space. It may be that they are sharing bedrooms, or you only have one living room for the family. As the children get older these space issues will become increasingly challenging.

New members of the family – With a new baby there are lots of changes in a household. If things are already tight for space, an extra family member will add extra strain. Consider the change in dynamic with existing family members and how an extra person will impact these. If you are feeling concerned, there is probably a good reason for it.

Make your decision and upsize your property

Love Your Postcode™ has become one of the top estate & lettings agents because of how our group pays attention to each client. With us, you’re guaranteed a trusted partner that know property prices in your area better than anyone and employs an experienced staff that anticipates your every need.

Unsure of what to don and want to talk through your situation? Book an appointment with one of our local area experts. or call us on 0800 862 0870.

By